Navigating Abundant Retirement

Learn how to enhance your family legacy

• FINANCIAL FREEDOM •

We help navigate the financial seas so you can get on with living!

WE SEE WHAT OTHERS CAN'T!

Therefore, finding conventional and alternative routes to achieve our clients' goals.

Don't Become Another Statistic

Take a stand against what threatens your retirement

Current National Debt

A Federal Reserve Survey reports...

- The average American feels they need to save $1.9 million for retirement.

- 4 in 5 Americans lack the necessary retirement planning to create a secure income.

- The average retired couple will need an estimated $300,000, post-taxes, to pay for health care expenses — not including long-term care.

- 96% of retirees are losing out on $111,000 of potential social security income due to common mistakes.

Click on the link below to learn everything you need to know to protect your retirement income and optimize all of your benefits.

Carol Dewey

Fiduciary Advisor | Speaker | Author | Podcast Host | Family Values

"We get up every morning to help families build protection, safety, and stability into their finances."

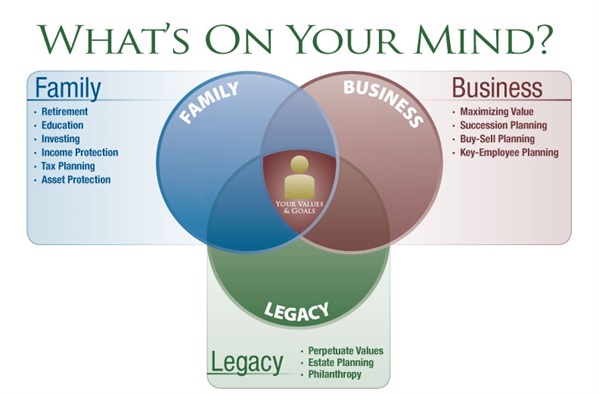

Let us help you integrate all the pieces of your financial plan into one cohesive plan that includes considerations for debt-reduction, college savings, tax mitigation, market volatility, Social Security optimization, and estate planning.

We work with strategic partners such as CPAs and estate planning attorneys to ensure that your financial plan is fully optimized and represents your family's values and objectives.

The Perpetual Wealth Navigation Solution

Our Unique Process To Give You Clarity About Living An Abundant Retirement

DISCOVER HIDDEN OPPORTUNITIES

We start with a conversation. This time together is designed to get to know YOU! Helping us identify where you are and where you want to go.

CHART YOUR COURSE

We work to create a strategy that shows a step by step plan on how to reach your goals. We gather all the pieces of your financial puzzle together under one unified plan.

NAVIGATION GUIDANCE

We walk through each step with you, providing guidance and advice as you move closer to your financial goals! And just like a home is built in a specific order, so is your wealth blueprint.

Download Our Most Recent and Timely Workbooks

Get the Tariffs & Your Retirement Guide + Take the 21 Point Wealth Assessment — a self-check tool that reveals hidden risks and opportunities in your current retirement plan.

If you’re looking to work less “in” the business and build something that works without you, this resource is a must-read.

Everything We Do Is Guided By Four Principles

Clarity

Building your roadmap for success starts by gaining clarity on where you are and where you want to go.

Efficiency

Optimize your cash flow and reduce unnecessary losses to accelerate your wealth faster than you ever thought possible.

Consistency

Build the habits of financial success to ensure you don't just create wealth, but can protect it and enjoy it for life.

Use

Financial independence is created by the money you work for. True wealth is created by the money that works for you.

Protect Your Family Legacy From The Uncertainties Of Tomorrow

It is time to become financially independent from

market volatility, inflation and government legislation!

- Break FREE From Rising Taxes

- Enjoy The Freedom of Diversification

- Pass on More Wealth to Your Heirs

WHAT ARE PEOPLE SAYING

This is an unpaid unsolicited client testimonial This client has had a financial relationship with CAROL DEWEY for over 3 years and is providing her personal opinion. This may present a conflict of interest as this particular client’s experience may or may not be the same as another client’s experience. This conflict is mitigated by our financial advisor’s fiduciary duty to tailor each client’s investment objectives to each individual client’s own financial situation. No compensation was paid to the client for this testimonial. A client testimonial does not guarantee future investment success and should not be indicative that any client or prospective client will experience the same or a higher level of investment performance. Foundations Investment Advisors, LLC is an SEC registered investment adviser. Past performance is not indicative of future results.

This is an unpaid unsolicited client testimonial This client has had a financial relationship with CAROL DEWEY for over 11 years and is providing her personal opinion. This may present a conflict of interest as this particular client’s experience may or may not be the same as another client’s experience. This conflict is mitigated by our financial advisor’s fiduciary duty to tailor each client’s investment objectives to each individual client’s own financial situation. No compensation was paid to the client for this testimonial. A client testimonial does not guarantee future investment success and should not be indicative that any client or prospective client will experience the same or a higher level of investment performance. Foundations Investment Advisors, LLC is an SEC registered investment adviser. Past performance is not indicative of future results.

Contact Us:

Office: (877) 434-6243

Hours: Monday - Friday | 9am - 5pm EST

927 Beville Road #104, South Daytona, FL 32119

Contact Us

Disclaimer:

Investment advisory services offered through Foundations Investment Advisors, LLC (“Foundations”), an SEC registered investment adviser. Nothing on this website constitutes investment, legal or tax advice, nor that any performance data or any recommendation that any particular security, portfolio of securities, transaction, investment or planning strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Foundations, execution of required documentation, and receipt of required disclosures. Investments in securities involve the risk of loss. Any past performance is no guarantee of future results. Advisory services are only offered to clients or prospective clients where Foundations and its advisors are properly licensed or exempted. For more information, please go to https://adviserinfo.sec.gov and search by our firm name or by our CRD #175083.